Net operating margin

In that case we will be able to interpret whether the net margin of Uno Company is. Hence Company B makes 27 Operating Profit on each dollar of sales.

Genevieve Wood I Picked This Diagram Because Of The Side By Side View Of The Contribution Margin And T Contribution Margin Income Statement Cost Of Goods Sold

On the trailing twelve months basis operating margin in 2 Q 2022 fell to 1815.

. Company A 200 2200 9. The net profit margin can be radically skewed by the presence of unusually large non-operating gains or losses. Introduction to Operating Margin.

Pre-tax Pre-stock compensation Operating Margin. Net Operating Income 70000. Operating margin is a more significant bottom-line number for investors than gross margin.

Hotels Tourism Industry Net Profit grew by 35694 in 2 Q 2022 sequentially while Revenue increased by 3151 this led to improvement in Hotels Tourism Industrys Net Margin to 139 above Hotels Tourism Industry average Net Margin. Remember that all margins formulas are trying to describe how much 1 in sales will convert to either gross profit gross margin operating profit operating margin or net profit income net margin. SP 500 Gross Margin Operating EBITDA Net and Pre Tax Margin high low and average from 2 Q 2022 - CSIMarket.

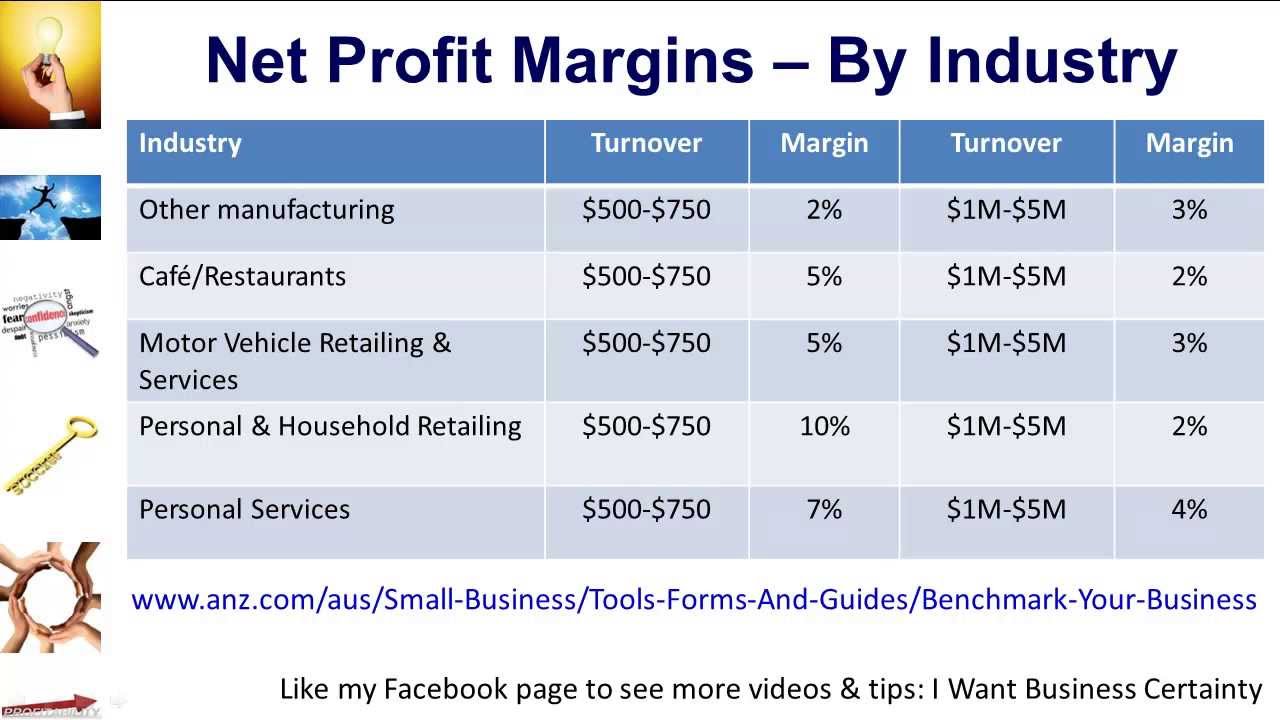

Operating Profit Margin differs from Net Profit Margin as a measure of a companys ability to be profitable. Typically expressed as a percentage net profit margins show how much of each dollar collected by a. Let us take the example of Apple Inc.

Net profit margin is the ratio of net profits to revenues for a company or business segment. DT Clinton Manufacturing company reported on its 2015 annual income statement a total of 125 million in sales revenue. Operating margin was 38 and non-GAAP operating margin was 42 increases of 80 and 100 basis points respectively Net income increased 113 and adjusted EBITDA increased to 51 an increase.

Company Name Ticker Competitors else. Net margin is a ratio that is typically expressed as a percentage though it may also be listed in decimal form. Gross Profit is calculated by deducting the cost of goods sold COGS from the revenue that is all the direct costs.

Pre-tax Lease adjusted Margin. Net margin measures how successful a company has been at the business of marking a profit on each dollar salesIt is one of the most essential financial ratiosNet margin includes all the factors that influence profitability whether under management control or not. Businesses thus are taxed on average profitability making the tax code more neutral.

What this means is that Company A makes only 9 Operating Profit on each dollar of sales. This means that 64 cents on every. The operating margin formula is the following.

Operating income before tax netted to 45 million after deducting all 80 million in operating expenses for the year. In the US a net operating loss can be carried forward indefinitely but are limited to 80 percent of taxable income. What is the formula for Operating margin.

This margin compares revenue to. A Net Operating Loss NOL Carryforward allows businesses suffering losses in one year to deduct them from future years profits. The higher the net margin the more efficiently the company is operating.

On the trailing twelve months basis Net margin in 2 Q 2022 grew to 831. Net Operating Income Formula Example 2. Here is how Christie would calculate her operating margin.

Net Margin Net margin also referred to as net profit margin is the third financial metric that can be used to measure business profitability. Gross Profit Margin is calculated as gross profit divided by net sales percentage. Using the formula of net margin we get Net Margin Formula Net Profit Net Sales 100.

Net Operating Income 500000 350000 80000. Suppose we compare this net margin with the net margin of companies under a similar industry. Pre-tax Lease RD adj Margin.

How to Use Operating Profit Margin. Operating Margin Operating Income Revenue. Operating Margin vs.

For example a large gain on the sale of a division could create a large net profit margin even though the operating results of the company are poor. An indicator of profitability calculated as net income divided by revenue. To calculate the concept of net operating income in the case of a real-life company.

After-tax Unadjusted Operating Margin. There are 3 types of profit margins. According to our formula Christies operating margin 36.

Operating Margin Operating Profit Net Sales. Company management could deliberately cut. Gross profit margin operating profit margin and net profit margin.

But Company B makes almost 3 times of Company A ie 27. Company B 800 3000 27. After-tax Lease Adjusted Margin.

While operating margin considers only the cost of goods and operating expenses involved in production net profit margin also factors in the interest and taxes. The higher the ratio the more effective a company is at cost controlCompared with industry. After-tax Lease RD adj Margin.

Pre-tax Unadjusted Operating Margin. Therefore DFG Ltd generated net operating income of 70000 during the year. For example a 15 operating profit margin is equal to 015 operating profit for every 1 of revenue.

From this example we find that the net margin of Uno Company is 1225. Operating profit margin ratio improved from 2019 to 2020 but then slightly deteriorated from 2020 to 2021 not reaching 2019 level. Mass General Brigham virtually reversed its earnings for the quarter ended June 30 compared to the same time in 2021 posting a 120 million operating loss and 949 million overall net loss one.

The difference is that the former is based solely on its operations by excluding the financing. Comparisons between two companies operating margins with similar business models and annual sales are. Operating Margin Operating Income Revenue X 100.

As you can see Christies operating income is 360000 Net sales all operating expenses. Net margin shows investors how much of the company revenue is retained as profit. Net profit margin ratio improved from 2019 to 2020 and from 2020 to 2021.

What Is Net Profit Margin Net Profit Net Profit

Gross Profit Vs Net Profit Definitions Formulas Examples Net Profit Accounting Training Profit

What Is Net Profit Margin Net Profit Net Profit

Infosys Q3fy18 Quarterly Results Investing Operating Margin Net Profit

Profit Margins In The Era Of Unprofitable Tech Platforms Fourweekmba Financial Ratio Netflix Business Model Profit

Operating Profit Margin Or Ebit Margin Profit Meant To Be Interpretation

Net Profit On Sales Accounting Play Accounting And Finance Accounting Basics Bookkeeping Business

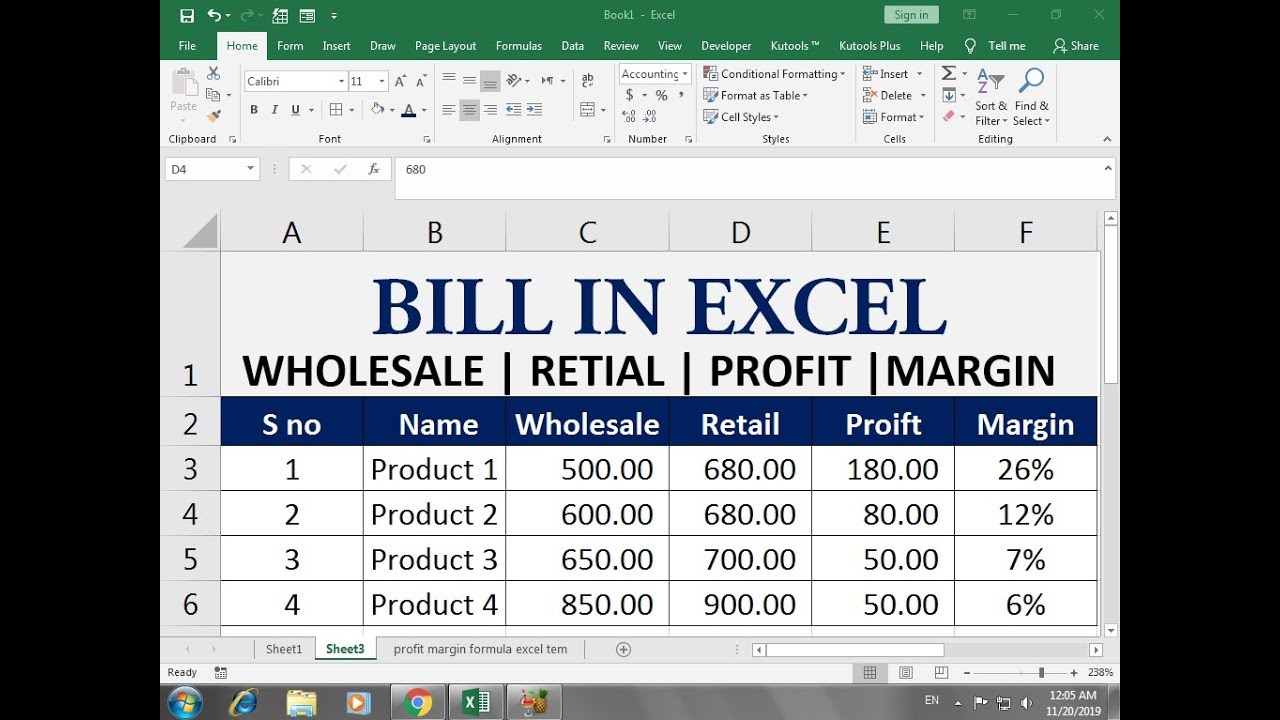

How To Calculate Net Profit Margin In Excel Net Profit Profit Excel

How To Calculate Net Profit Margin In Excel Net Profit Excel Billing Software

Lcekux2vwllusm

Profitability Strategy To Rocket Your Net Profit Business Development Strategy Profit Margins Business Development Strategy Net Profit Business Development

The Difference Between Gross Profit Margin And Net Profit Margin Net Profit Profit Company Financials

How Income Statement Structure Content Reveal Earning Performance Income Statement Income Profit And Loss Statement

Income Statement P L Statement Template Free Report Templates Income Statement Statement Template Report Template

Gross Vs Net Difference And Comparison Diffen Budgeting Operating Margin Gross Margin

Net Profit On Sales Accounting Play Accounting And Finance Accounting Basics Bookkeeping Business

How Income Statement Structure Content Reveal Earning Performance Income Statement Income Profit And Loss Statement